Can You Roll A Variable Annuity Into A 401k

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities2-9c9db03774fd45fc83501879e123f82d.png)

This is because 401 k plan contributions are tax deductible while annuity contributions outside of a retirement account are not tax deductible.

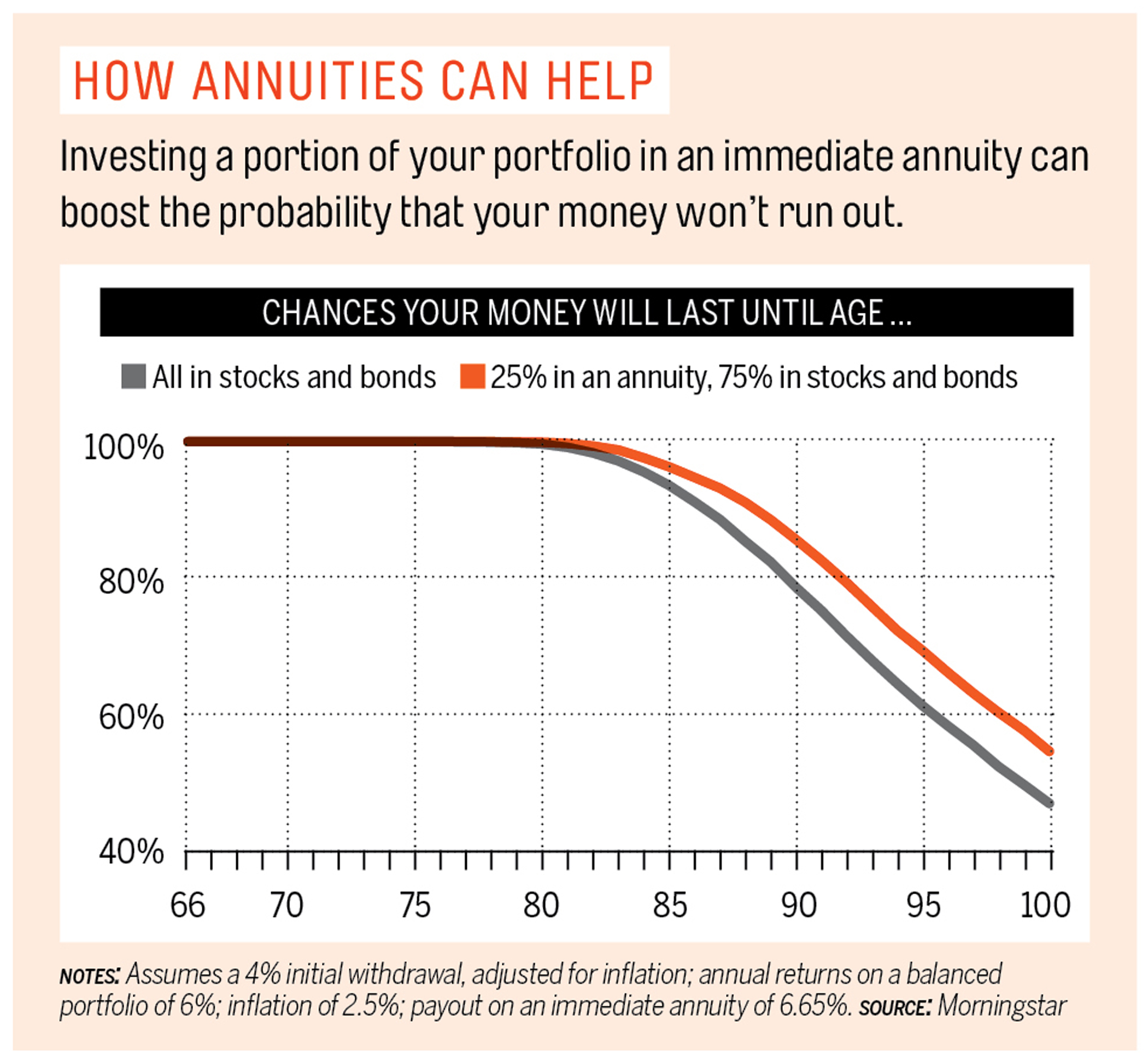

Can you roll a variable annuity into a 401k. Your retirement savings are safe and secure. Contact your insurer and request a 1035 exchange. Annuities funded with an ira or 401 k rollover are considered qualified plans. Using part of your 401 k or ira funds to buy an annuity can provide income in retirement.

Only deferred annuities may be rolled into a new annuity. If you own an annuity in a regular taxable account then there s no way to roll it over into a 401 k plan. This exchange allows you to move the money directly from one annuity contract to another. Once you retire no one is contributing to your 401 k any longer.

Benefits of rolling over a 401 k or ira into an annuity. You may roll over your deferred annuity into a new deferred annuity or an immediate annuity. However a traditional 401 k is already tax sheltered and a delayed rollover could cost you in taxes. You have someone looking out for your investment.

Commingling qualified plan money with annuity assets that weren t initially treated as. You can roll over your ira 401 k 403 b or lump sum pension payment into an annuity tax free. If your plan allows you can roll an annuity into your 401 k plan but only if you held your annuity in an individual retirement arrangement or another 401 k plan to begin with. If you are moving non qualified money tax free then that is technically called a 1035 exchange.

Some states place restrictions on your rollover. Tax protected retirement savings accounts such as iras or 401 k plans can be directly rolled over into an annuity tax free as long as you follow the irs s requirements. There are 2 major benefits of rolling a 401 k or ira into a fixed annuity. Then 401k annuities will offer another income stream that you can never outlive.

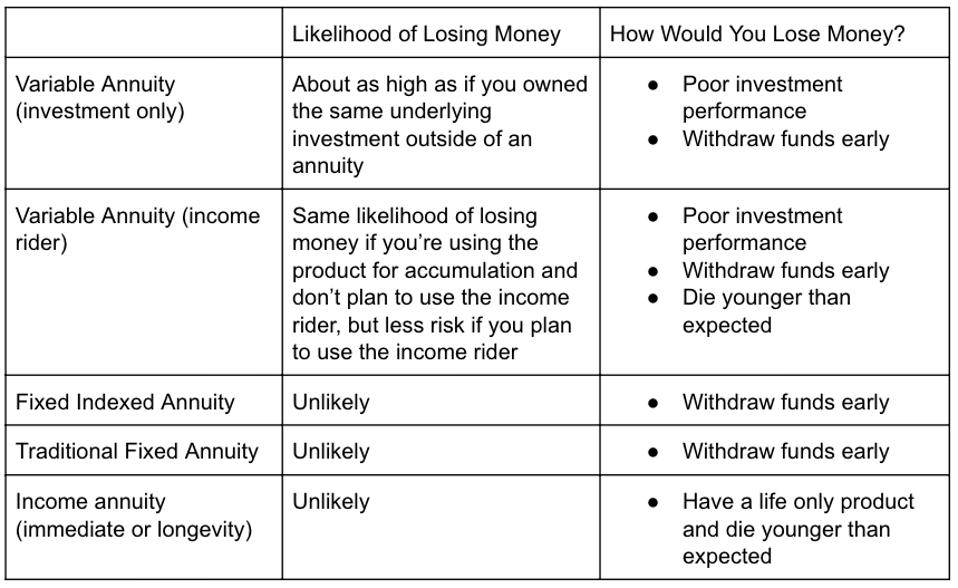

Annuities funded with an ira or 401 k rollover are qualified plans enabling an insurance company to create an ira annuity into which you can deposit your retirement funds directly. Non qualified just means it s not an ira 403b or 401k. Key takeaways annuities can come with a host of fees and charges that reduce your funds. You can transfer your 401k to an annuity.

Both are questions that involve a 401k rollover strategy.

/annuity_blocks-5bfc2f6146e0fb00511a6201.jpg)

/success-1093889_1920-73785c60ea884a3eb06341d5e7422b07.jpg)

/annuity-1a2c27eba1cb4ecf85aca9e888096cbd.jpg)

/shutterstock_290211914.annuity.zimmytws-550330c4cd704eecb80e957bff0960f3.jpg)

/GettyImages-1131086835-83fd238d51f44798943a4e69c1198537.jpg)

/GettyImages-926129268-635036cfea674e89bd4153eda9c0f951.jpg)

/GettyImages-1146031987-6240be09e5344ea1a5414fa09008fab1.jpg)